The organization receives payment from individuals to the Yandex.Money wallet: how to register it. Types of e-wallets

The organization has an electronic wallet in the Yandex.Money system, which receives payments for goods from individuals. For example, from the buyer to the account of the electronic wallet, the amount of 4290 rubles was received for the goods. The next day, the bank transfers these funds to and withdraws a commission of 141 rubles for the transfer. That is, in fact, an amount of 4149 rubles is received on the current account. After the funds are credited to the current account, the organization releases the goods to the buyer. What accounting entries should be made in this case?Electronic money settlements are made using electronic means of payment. Electronic means of payment include means and (or) a method that allows the client of the money transfer operator to draw up, certify and transmit instructions for the purpose of transferring funds within the framework of the applied forms of non-cash payments using information and communication technologies, electronic media, including the number of payment cards, as well as other technical devices (clause 19 of article 3 of the Federal Law of June 27, 2011 N 161-FZ "On the National Payment System", hereinafter - Law N 161-FZ).

Yandex.Money is one of the electronic payment services in which you can open (register) an electronic wallet (electronic means of payment).

To make settlements with electronic money, the organization must conclude an agreement with the money transfer operator (clause 1 of article 4 of Law N 161-FZ). The operator can only be a credit institution (bank) (see also clauses 1, 4, article 86 of the Tax Code of the Russian Federation).

Organizations can only use corporate electronic means of payment. An electronic means of payment is corporate if it is used with the identification of the client by the operator of electronic money in accordance with Federal Law of 07.08.2001 N 115-FZ "On Combating Legalization (Laundering) of Criminally Obtained Incomes and Financing of Terrorism" (clause 7 Art.10 of Law N 161-FZ). The bank informs the tax authority about granting (or terminating) the right to use, about changing the details of the corporate electronic means of payment (paragraph 2, clause 1, article 86 of the Tax Code of the Russian Federation).

The balance (part of it) of the electronic money of a client - a legal entity can be credited or transferred only to his bank account at his order (part 22 of article 7 of Law N 161-FZ).

Accounting

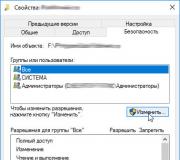

The current accounting legislation does not approve transactions carried out using electronic means of payment.In practice, there are several options for reflecting electronic means of payment in accounting. The first option is based on the use of account 55 "Special accounts in banks", the second - account 76 "Settlements with different debtors and creditors". In such a situation, we believe that the organization has the right to independently choose the option used for reflecting electronic means of payment in the accounting and approve it in the accounting policy (part 4 of article 8 of the Federal Law of 06.12.2011 N 402-FZ "On accounting", p. 7 PBU 1/2008 "Accounting policy of the organization").

In accordance with the Chart of Accounts for accounting of financial and economic activities of organizations and the Instructions for its use, approved by order of the Ministry of Finance of Russia dated October 31, 2000 N 94n (hereinafter referred to as the Instructions for the Chart of Accounts), account 62 is intended to summarize information on settlements with buyers and customers. Settlements with buyers and customers ".

Income (revenue) from the sale of goods are income from ordinary activities (clause 5 of PBU 9/99 "Income of the organization"), which are reflected in account 90 "Sales".

Despite the fact that the proceeds go to the organization's account minus the bank's commission, it is accepted for accounting in an amount calculated in monetary terms equal to the amount of cash and other property receipts and (or) the amount of receivables (clause 6 of PBU 9/99 ), that is, in full.

Expenses related to payment for services rendered by credit institutions (banks) are related to other expenses (clause 11 of PBU 10/99 "Expenses of an organization") and are reflected in the account, subaccount "Other expenses".

In our opinion, in the situation under consideration, accounting transactions can be reflected as follows:

Debit (), subaccount "Electronic wallet" Credit

- 4290 rubles. - payment has been received from the buyer;

Debit Credit (), subaccount "Electronic wallet"

- 4149 rubles. - funds have been transferred to the current account;

Debit, subaccount "Settlements with the bank" Credit

Various online stores and virtual services today are a fairly popular and rapidly developing line of business, which attracts not only legal entities (LLC, PJSC), but also individuals, individual entrepreneurs. However, such a vector of activity hides great complexity: how to organize a system of payment for goods and services? Of course, you can develop your own version. But why reinvent the wheel if there is a convenient service - Yandex Kassa? It is also available for individuals. We will figure it out in the intricacies of its work, the benefits of using it. We will also provide detailed instructions for connecting.

What is it?

To begin with, we will consider what Yandex Cashier payments are. This is the name of the domestic payment aggregator. In other words, a service that accepts payments from buyers and consumers of services in favor of individuals and legal entities. The latter can be online stores, cafes, charities, utilities, training centers, etc.

The Yandex Cash service (for individuals including) is available for organizations and entrepreneurs registered in the Russian Federation and neighboring countries. But payments to them can be transferred by clients from all over the world.

The aggregator dates back to 2013. Directly managed by Yandex Money payment holding. Research by experts for 2015-2016 evaluate this payment solution as the most popular in the Russian Federation. As statistics show, about 30% of Russian sites (Internet retailers, portals of government services, etc.) have chosen this particular settlement system.

How do I pay and withdraw funds?

The advantage of Yandex Cashier (there are restrictions for individuals) is that buyers and consumers can choose any of the most convenient account repayment options. This favorably distinguishes the service from competitors. How to transfer money:

- Through a bank card.

- Through Yandex Money and other popular electronic wallets.

- Directly through portals and mobile applications of such well-known corporations as Alfa-Bank, Sberbank, Promsvyazbank, etc.

- Through the account of your own mobile phone number.

- Through contactless technologies (for example, Apple Pay).

- Cash settlement through 250,000 points of receipt, dispersed throughout the Russian Federation and other states.

An entrepreneur can withdraw money from an account twice a day. It is important that Yandex Kassa cooperates with stores only in full compliance with the Federal Law of the Russian Federation No. 54 (on online settlement). That is, an individual entrepreneur or LLC must submit reports on each payment received through the system to the tax office. Otherwise, the entrepreneur is fined or his business is closed.

Functionality

The list of Yandex Checkout functionality (they are also available for individuals) is constantly growing. Let's see what the payment aggregator can do today:

- Issue invoices in messenger applications, chats, SMS, email.

- Connecting auto payments (automatic debiting of funds on a specific day).

- Linking a bank card to a Yandex account (the buyer does not need to enter data from it every time).

- Pre-authorization services. In other words, the freezing of funds in the client's account as part of a prepayment. Subsequently, this amount is immediately debited at the command of the store or service provider. Very relevant for those whose work may need a quick refund to the client.

- Payment is available both "here and now", and on credit, by installments.

- The newest options: "safe deal", mass payments, accepting payments through the Telegram and Viber messengers, through the mailing of e-mails and online consultation chats on the sites.

The main advantages of the service

In 2017, the Yandex Cash service for individuals, LLCs, PJSCs and government organizations was recognized as the leader among their own kind. In some ways, the success was associated with the popularity of his "older brother" - "Yandex Money".

The main advantages are the following:

- Easy sending of statistics on the received profit to the tax office.

- Convenient personal account.

- Keeping statistics on income, transfers.

- A wide range of methods for clients to pay off invoices.

- Relatively small commission (from 2.8 to 3.5%).

- The ability to carry out massive payments according to the prepared templates.

- Sending invoices to customers - a wide variety of ways (instant messengers, SMS, chats on your own website, e-mail).

- Ready-made standard modules.

- Reliability and safety of settlements guaranteed by the authority of the Russian corporation "Yandex".

- The refinement of the technical side of the issue (many years of experience in the operation of the Yandex Money system, a large number of corporation servers).

Disadvantages of the service

Reviews of Yandex Checkout for individuals also highlight the annoying disadvantages of cooperation with this service:

- Restrictions on payments in cooperation without drawing up a contract.

- The presence of commission fees in tariffs for transfers, withdrawal of funds.

- The ability to link only one site.

- Difficulties in drawing up a payment form for those entrepreneurs who do not have web programming skills.

Is it possible not to register an individual entrepreneur?

An important feature: in order to connect Yandex Cashier to your online store, you do not need to register an individual entrepreneur or LLC. However, such a convenient opportunity entails a number of restrictions on the use of the service:

- Increased commission for withdrawal of funds (3-6%).

- Withdrawal only to Yandex Money. If the wallet of the entrepreneur is below the nominal status, then the transfer of funds further to the bank card is impossible.

- Two options for paying invoices for the buyer.

"Yandex Payment" - what is it?

Yandex Payment is a simplified Yandex Cashier. For individuals, the principle of its operation is simple: the buyer or consumer, in fact, instead of an individual entrepreneur, replenishes his electronic wallet ("Yandex Money").

Another important advantage of connecting "Yandex Payments" - for this service you do not need to confirm your identity, fill out a document on cooperation. An entrepreneur is required to register in the Yandex Money system, connect to Yandex Payment, and compile a form of payment for his clients.

How do I transfer money? Consumers and buyers can pay bills in the same way as in relation to Yandex Cashier - through a bank card, e-wallets, etc. An entrepreneur, on the other hand, has the opportunity to withdraw funds only from Yandex Money to a bank card with a commission of 3% (+ 45 rubles).

Registration in the system for individuals

Let's consider how to connect Yandex Checkout for individuals:

- Open the main page of Yandex Money.

- Click on "Create Wallet".

- You can register it through your profile in one of the social networks or choose the option with the preparation of a username and password.

- After registration, it is enough to confirm your email address - follow the letter with a link.

- Go to your personal account in the Yandex Money system, click on "Accept payments".

- Choose one of the options that you want to see on your site. The simplest is the standard "Form". You can also opt for Button or Custom (if you're good at web development).

- The constructor will ask you to enter information into the form that will be reflected on your site. Attach a bank card to your cash register to withdraw funds from clients to it.

- Copy the code provided to you by the system.

- You can later paste the code into your own web resource. This is enough for it to work properly.

Note that the created wallet has the "Anonymous" status! This means that you can only store up to 15 thousand rubles on it. Users note that it is not uncommon for the system to delete anonymous wallets along with the funds stored on them.

Therefore, for the safety of your income, upgrade your status to "Named". To do this, it is enough to send a scan of your own passport, following the prompts of the system. With "Named" the volume of the wallet grows to 60 thousand rubles. In addition, such a profile is not deleted due to prolonged inactivity.

Further expansion of the capabilities of the Yandex e-wallet is already paid. This status is "Identified", which allows you to save up to 500 thousand rubles on the account.

Analogs

Of course, the Yandex Cash service is not the only one of its kind. It was created following the example of existing foreign analogues. Among the most convenient and secure in their environment, users distinguish the following:

- Unit Pay.

- RoboKassa.

- Wallet One.

- Payeer.

Yandex Checkout is a convenient payment service created specifically for virtual stores and online service providers. To connect your business to it, you do not need to register an LLC or individual entrepreneur. However, this imposes certain restrictions on cooperation, does not allow using the functionality of the system to its full potential.

We have released a new book, "Content Marketing on Social Media: How to Get Into the Heads of Subscribers and Fall in Love with Your Brand."

Yandex cash register is a special technology from Yandex that allows you to accept payments in various online services / online stores.

Also, using this service, you can send money to users and solve a wide range of tasks related to the implementation of Internet payments.

To understand what Yandex cash desk is, consider a simple analogy. We shop almost every day. Today it is already difficult to find a point of sale where a cash register has not been installed. With its help, the seller issues an invoice and keeps records of activities, finances. An analogue of a cash register for services operating on the Internet is Yandex cash register.

Today you can use the following payment methods through Yandex cashier:

- Through internet banking applications and from a mobile number.

- Using bank cards of all systems: Maestro, Visa, Master Card.

- Cash through specialized terminals.

- Through e-wallet accounts.

How Yandex Checkout works

This tool is needed by the owners of online stores. It allows you to organize work with.

Any company can become a partner of the Yandex.Kassa service. The only condition is that the company must be registered as a legal entity.

To work, you need to connect the cashier to an online service / website / blog. You can use the cashier not only to receive payments from clients, but also to settle accounts with freelancers, hired employees, and so on.

The system can also function offline. With its help, you can issue invoices for customers in the form of SMS, so that they make payments from smartphones, as well as accept payments through mobile terminals.

Pros and cons of Yandex cash register

Advantages:

- The reputation of the resource is being strengthened, and in the eyes of consumers it looks more reliable. Consequently, the influx of users is increasing.

- The owner protects his store from scams and various shenanigans.

- It is easy and convenient to connect and use the system.

- A wide range of tariffs allows you to choose the best option based on the budget and characteristics of your particular resource.

- Payment from clients is carried out promptly, within one day. At the same time, it does not matter in what way the payment was made.

- Additional opportunities are possible, which are provided within the extended offer "Kassa Plus". Here the system works even in the absence of an Internet connection, in offline mode.

- Work and acceptance of payments are carried out without interruptions and interruptions in work. Even if one payment gateway is overloaded, the system immediately switches to another, users will not even feel such actions.

- Yandex.Checkout operates strictly in accordance with the current legislation of the Russian Federation and the standards of the Bank of Russia. The system also meets the requirements of PCIDSS (International Financial Certificate).

- There is a detailed reporting form from which you can get detailed information about all transactions performed. This makes accounting much easier.

Among the shortcomings, it can be noted that after making a payment through Yandex cashier for an online store, there is no way to return to the previous web page. We'll have to reopen the site. There are also minor problems in the work of the personal account, but they are easily removable and now Yandex is doing this.

How to connect Yandex checkout

Connection takes place in several stages.

Step 1

First you need to send an application. In the application, such sections are filled in as: full name and email address of the contact person (the Yandex manager will communicate with him), phone number (the number must be valid), website URL, company tax number, country, company type.

Step 2

We go to the created personal account to start working with the service. To do this, follow the link: https://money.yandex.ru/my/questionnaire and fill out the special connection form presented here. After all sections are completed, submit the application.

Step 3

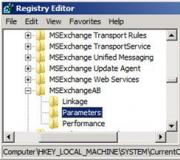

Now we are setting up our checkout. Open the settings and select the set section. In the section of payment modules, select "Ecwid" and move on. Here will be presented various items in which you need to register links. The picture shows what exactly needs to be entered into the questionnaire.

Also, here you need to disable the functions of using the success and errors page and making test payments. In the "Email" section, enter your valid email address, and in the ShopPassword field, create a password. Now you can send the questionnaire.

Step 4

Now you will receive the data to perform the settings, namely the scid number and shopID number.

Step 5

Open the panel for managing your Ecwid store and open the payment point. Here you need to connect Yandex checkout.

After that, the settings window will open, where you need to enter the data received from the letter from Yandex, namely the scid number and shopID number and your password. Then we turn on the work in test mode and save the changes made. Then a new window will open, in it we configure the payment methods. Once set up, complete a couple of transactions, complete orders and pay for them.

Step 6

Now you know that the system is configured correctly and is working. Inform the Yandex system that the work in the test mode has been successfully completed, send a response letter to the message with your username and password. Then the system will send a response. As soon as you have received a response, you can turn off the test mode and add the sent scid and shopID. If everything is successful, customers will see all available payment methods. This section looks like this:

Here the client chooses a method that is convenient for himself and goes to the appropriate section.

The intuitive interface, simplicity and ease of the system ensure efficient work. If you have any questions, you can always contact technical support.

Electronic money has long ceased to be just a virtual currency, now it is a legal means of payment. Legalized electronic money by the law of 27.06.2011 No. 161-FZ "On the national payment system".

It is not easy to understand the text of the law, for example, the concept of electronic money in Article 3 it gives the following: “Electronic money is money that has been previously provided by one person (the person who provided the money) to another person who takes into account information on the amount of funds provided without opening bank account (to the obligated person) to fulfill the monetary obligations of the person who provided the funds to third parties and in respect of which the person who provided the funds has the right to transfer orders exclusively using electronic means of payment ”.

There is no particular point in thinking about such a cumbersome formulation, because most Internet users know how electronic money works from their own experience. The functionality of electronic money is quite wide. They can pay not only for housing and communal services, taxis, communications, digital goods and goods of online stores, but even pay taxes and traffic fines.

But that's not all. Electronic money allows businessmen to pay remuneration to individuals under civil law contracts (usually freelancers on the Web), transfer funds to an accountable person, and return money to a client when goods are returned. True, in order to legally take such calculations into account in business, an electronic wallet should not be an ordinary one, but a corporate one.

It makes sense to use electronic wallets only as an additional way to receive payment for goods and services. It is not worth using them as a means of accumulating and preserving free money. They do not accrue interest, as on deposits, and are not subject to the rules on deposit insurance.

Types of e-wallets

The type of electronic wallet is determined by what information the owner has provided about himself:

- anonymous(non-personalized) wallet is opened if the owner has not informed the electronic money operator of his passport data;

- personified the owner of which has undergone simplified identification by indicating his passport data;

- corporate, which is opened by individual entrepreneurs and organizations, assumes its identification using TIN.

The higher the level of identification of the owner of the wallet, the larger amounts of electronic money can participate in settlements. So, the limit of settlements per month for an anonymous wallet is 40 thousand rubles, and for a personalized one - 200 thousand rubles.

When using a corporate wallet, there are no restrictions on the amount of settlements per month, but there is a limit on the balance of electronic funds at the end of the working day - 600 thousand rubles. The surplus is automatically credited to the current account of the owner of the corporate wallet without his order.

Organizations and individual entrepreneurs cannot settle with electronic money among themselves. One of the parties to such settlements must necessarily be an ordinary individual, and if payment is made using electronic money under a civil law contract, the recipient's wallet must be personalized.

How to open a corporate wallet

Consider opening a corporate wallet using Yandex money as an example. Especially for this case, the payment system has created a service

An important innovation for online stores - from July 1, 2018, cash registers will have to be used in cases of online payment by card or through services such as Yandex Checkout. In this case, the buyer receives only an electronic check. Previously, there was no such requirement. For online fiscalization, you can use the Yandex.Checkout solution with a partner cash register or your own version, for example, sending checks using CMS or CRM systems. Yandex.Checkout will transmit information about orders and payments to your cash register and inform the store about successful payment and check registration.

If you provide distant services / sell goods and have not yet connected Yandex.Checkout, we advise you to do it right now. Today it is the most adapted payment service to the new law. By leaving a request using the button below, you will receive 3 months of service on a premium tariff with a minimum percentage (the connection itself is free):

In the application for connection, you must indicate the type of entrepreneur (legal entity or individual entrepreneur), TIN, contact information, website (if any). Next, you need to fill out a connection form.

The corporate wallet is tied to the current one, so it must already be open.

All that remains is to download a scan of the manager's or individual entrepreneur's passport and conclude an agreement with the Yandex-money payment system. If you want to connect Yandex money payment through a widget on your website, you will be sent technical documentation for setting the codes for payment buttons or payment module.

Electronic payment systems in Russia

Law No. 161-FZ recognizes the Bank of Russia, credit institutions (including non-banking ones) and Vnesheconombank as money transfer operators. To connect a corporate wallet, you need to contact a registered payment NCO (non-bank credit institution).

The table contains the main NPOs registered on the website of the Central Bank

In addition, such payment systems as QIWI-wallet belonging to QIWI Bank and Robokassa (OCEAN BANK service) are popular for connecting payments via electronic money.

But another popular payment system like WebMoney is not a credit institution registered in accordance with Law No. 161-FZ, although it also offers organizations and individual entrepreneurs the ability to connect to pay for goods and services on the Internet. Based on this, when making payments through WebMoney for business purposes, difficulties in accounting for the movement of such funds are possible.

Electronic money accounting

Law No. 161-FZ equated settlements with electronic money with non-cash payments, therefore, in accounting and tax accounting, they are accounted for according to the same rules as non-cash funds.

The Ministry of Finance believes that for taxpayers of the simplified tax system, the moment of income recognition arises at the moment when money from a buyer or a client has entered an electronic wallet, and not to a current account linked to it.

“The moment the buyer’s debt to the organization is repaid is the moment when the electronic money operator simultaneously accepts the order, decreases the payer's electronic money balance and increases the recipient’s electronic money balance by the amount of the electronic money transfer. This moment is the date of recognition of income from the sale of goods. " (from the letter of the Ministry of Finance dated January 24, 2013 N 03-11-11 / 28). In this case, the entire amount of sales, excluding bank commissions, is recognized as income.

Payers of the common system, using the accrual method to record income from sales, account for income in the form of electronic money at the time of sale of goods or provision of services, regardless of the actual receipt of funds.

The income of an individual who received electronic money for his services entails the same tax consequences as when receiving money in another form. If the money is transferred by an organization or individual entrepreneur, then they act as tax agents in relation to this income, therefore they must withhold personal income tax.

,) about the methods of accepting payments on the site. In the previous articles, there was one condition - connection to payment systems was made as an individual. Now I decided to get out of the twilight to do everything as honestly as possible, and I want to talk about how to connect to payment systems as an individual entrepreneur and legally withdraw earned money to a bank account.

Unfortunately, the process of connecting to payment systems as an individual entrepreneur is always overshadowed by the fact that in order to withdraw money (and sometimes just to enter your personal account) you need to sign an agreement and wait until it reaches the payment system in paper form. therefore, in this article, in most cases, I will describe only the theoretical and informational parts of cooperation with payment systems and aggregators.

In general, in order to connect to payment acceptance, you need to exchange an agreement with a payment system, so you don't have to rely on a quick connection. Plus - this agreement must be manually processed, so if you do not take into account the time spent on sending documents by Russian Post, then the connection takes three days. The package of documents is approximately the same for everyone, but sometimes you may need a copy of a document certified by a notary or, for example, a fresh extract from the USRIP.

So, the heroes of today's review: WebMoney, Yandex.Kassa, PayPal, Wallet One, RBKMoney, PayMaster, RoboKassa, QIWI

While writing this article, I decided to check the quality of the technical support work a little and asked a few clarifying questions about the connection. All questions were sent on the night from Thursday to Friday, and in the morning I began to receive answers. I had no complaints about the quality of the answers, but not everyone is smooth with the speed.

I received the first answer at 11.41 from the Wallet One service: they explained everything in some detail, and I did not have any additional questions. RBKMoney received a response a minute later, and I have no complaints about it either. The next answer is from PayPal. On the whole, he suited me, with the exception of a completely formulaic answer to the question about the advantages over competitors.

Unfortunately, on the same day, I received no more answers. The answer from RoboKassa came 38 hours after the request was created, and they decided not to write about their advantages at all, but from Yandex.Checkout they sent an answer only on Monday, which made me very sad, but there were no complaints about the quality of the response.

I asked each service a question about their advantages over competitors, and now I would like to post the answers:

Wallet One

- more than 100 methods of accepting payments (cards, online banking, mobile payments, cash through payment terminals, etc.)

- multicurrency, the possibility of expanding business outside the Russian Federation

- fast integration, help from our technical support, personal manager

- development of an individual payment page with the removal of individual payment buttons, selection of optimal payment methods, as a result of an increase in conversion into payments

- own audience - more than 7 million wallets are registered in the W1 system, the possibility of holding joint promotions

RBKMoney

The main advantages of our service in comparison with other services are, for example, multi-acquiring, high conversion, bilateral agreement, availability of an NPO license, round-the-clock support service, security and stability of work.

PayPal

Keeping your PayPal account secure is our top priority. We provide both physical and electronic protection for your data. More than 2,000 specialists work in our company, providing protection against fraud and theft of credentials.

PayPal supports 26 currencies. PayPal has 152 million active users in 205 different countries.

Yandex.Checkout

- the presence of many types of payments

- short terms of transferring funds to bank account

- ensuring a high level of security of confidential data

- comfortable interest rates on payments

In the case of IP, connection to WebMoney it is quite simple: you need to have a personal passport of an individual and "bind" the existing WMID to the individual entrepreneur. Connection takes place quite quickly, after filling in the data on the site, a letter comes from a WebMoney employee with instructions and an agreement. The contract must be printed, signed and sent by regular mail along with the rest of the documents. Of the small drawbacks: the contract must be flashed on your own (this may cause a little difficulty for the programmer, but the chocolate bar and any girl you know solve this problem) and make a notarized copy of one of the documents. Otherwise, I had no problems, and the connection took 5 days, taking into account the sending of documents by courier.

After checking the documents, the specified WMID has the opportunity to withdraw money to the account of the individual entrepreneur. That is, in fact, connecting to WebMoney as an individual entrepreneur is no different from working as an individual. persons, except for the need to exchange documents. Money is transferred to WebMoney wallets in the same way, the withdrawal fee is completely the same - 0.8%. Automatic payment acceptance is configured completely in the same way - as for individuals. faces.

pros: low commission, fast connection

Minuses: this is not an aggregator, but a payment system, therefore only WebMoney can be accepted

![]()

Yandex.Kassa is a project from Yandex.Money for accepting payments in various ways. In addition to Yandex.Money through the Cashier, you can pay using bank cards, WebMoney, through mobile phone stores, from a mobile phone balance and through Internet banking of some banks. After making a payment to users, the money is credited to the bank account the next day. Yandex.Checkout's commission is quite high - from 2.8% to 5%. The percentage depends on the turnover and the type of product: if you sell services or digital content, the rate will be higher. The largest percentage (5%) is obtained when paying for digital content or services with Yandex.Money, and this percentage does not depend on the turnover.

As indicated on the Yandex.Checkout website, you only need to provide an individual entrepreneur's passport to connect, and usually the connection process takes no more than three days. After that, you need to provide a signed agreement and exchange acts once a month. From the "buns" of the Checkout, the following can be noted:

- Card binding: the user once binds his card and can make the following payments without re-entering the data.

- Repeated payments: you can set up automatic debiting of money from the card if the service works by subscription.

- Pre-authorization: the ability to write off money not at the time of the transaction, but after some time.

- Mobile terminal: the ability to accept payments from cards via a smartphone.

pros: the presence of interesting "buns", to connect you only need a passport

Minuses: high commission when paying via Yandex.Money, no mobile app

![]()

PayPal will be of interest to those who plan to sell goods or services to foreign customers. I want to say right away that this payment system has a very large commission: from 2.9% to 3.9% + 10 rubles for each transaction. Plus, there may be commissions for international payments and the internal exchange rate is very unprofitable. Consequently, small payments will be extremely unprofitable in terms of commission due to the presence of a 10-ruble component. Integration with the PayPal website is not the easiest one, but PayPal offers to use their buttons, with which everything becomes much easier. Of the minuses of PayPal, I can also note the lack of the possibility of contacting technical support without logging into an account (well, or I simply did not find such an opportunity).

pros: large system

Minuses: high commission + constant commission component

Wallet One is a project that I talked about in the first post and which has changed a lot for the better since that time. The site looks modern, so I even had a desire to register and see what is inside. When registering, the system asks for an e-mail and come up with a password. After that, you need to enter the address of your site. It seemed redundant to me that the system asks the user to confirm both the e-mail and the phone number, and the ownership of the site. Inside, there was a pretty nice adaptive design, so the owners of smartphones and tablets will not suffer much. The payment pages themselves are also mobile adapted and, in general, look nice, so that customers will not have problems when paying.

You can accept payments immediately, without concluding a paper agreement, but in order to withdraw money, you must already exchange paper versions of documents.

From a technical point of view, the integration with the site does not look very complicated, the usual form with data. Also in the settings you can choose through which systems we will accept payments. By default, almost all systems are activated, except for bank cards, WebMoney. Yandex.Money and mobile commerce. But activating them is not so difficult, for example, for Yandex.Money, you just need to confirm that the commission will not be passed on to the client. The single checkout takes an average commission for its services, for example, on cards, the commission at the start (at zero turnover) is 4%.

Among the advantages, I can also note the presence of a mobile application and the ability to create recurring payments. True, this opportunity is not connected to everyone, but at first they are interested in why it is needed. Another advantage when working with foreign clients is the ability to work with different currencies. Similarly, PayMaster (about it below) has a "built-in" delivery service for Moscow and St. Petersburg.

pros: convenient and modern website, fast connection, acceptable commission

Minuses: to connect “big players” you need to perform additional actions

I worked with RBKMoney as an individual, but at one point they said that they no longer work with individuals. This aggregator, in addition to accepting payments through its local currency, offers online stores to accept payments using bank cards, Russian Post, via bank transfer, through mobile shops, payment terminals, using money transfer and Internet banking. The set is quite standard, but there is one big drawback - there is no possibility to accept payments through major players (Yandex, WebMoney, QIWI).

However, there is a bonus similar to Yandex.Checkout - you can get a reader for your smartphone with which you can accept payments offline. The commission for this system is the same: 3.9% for any payment. In my opinion, this is a big plus, there is no need to think about the fact that the user needs to "slip" a cheaper payment system. However, there are no regular discounts depending on the volume of transactions. On the plus side, I can point out round-the-clock support via online chat.

pros: fairly low and flat commission

Minuses: no “big players” (Yandex, WebMoney, QIWI).

I worked with the PayMaster system only as a client, paying through them for the services of other companies. After browsing their website, I have more questions than answers. On the main page it is proudly written that the commission starts from 2%, but, unfortunately, more detailed information is not indicated anywhere, and you can get it only after registration and approval of the application by the manager.

Commission - from 2% to 7%. You will find out the details after your application is approved.

You can also get acquainted with the technical documentation only after connecting:

As soon as the manager approves your application, you will get access to your PayMaster personal account. In it, you will familiarize yourself with the settings and documentation.

To be honest, I don't fully understand such secrecy, so I didn't even bother to find out the details. Of the advantages, I can note that they have a fairly large list of payment systems and there is integration with logistics services for those who send goods to customers.