Steal the impossible. A short educational program on the topic of how bitcoins are stolen

There are different ways to steal Bitcoin. Using several methods, unscrupulous companies steal your bitcoins. Let's look at the most common options.

How to steal Bitcoin from a wallet

Since the beginning of the opening of companies to the industry, there have been complaints from customers that their bitcoins were stolen from them, and technical support is unable to resolve the problem.

If you have any amount of bitcoins, you need to store them somewhere. You contact a company that provides a platform for creating . Crypto wallet providers try to make the procedure for organizing and managing accounts as easy as possible; for this purpose, keys are often stored in the system.

- It's possible that some companies are abusing the fact that they have access to your private key. They simply transfer clients' funds to other accounts.

- Perhaps losses and lack of enrollment are the result of weak software and errors. Because often, after proceedings, the money is restored.

Complaints of this kind are found against any company specializing in organizing bitcoins. It is worth considering here that some of the complaints are the machinations of competitors. Traditionally, large payment systems for virtual currencies that have been operating for several years value their customers.

The digital industry itself is quite young, like most service firms for Bitcoin and other cryptocurrencies. Many companies are less than five years old, which is not enough time to build a strong reputation.

The risks are really greatest when the user decides to trust a new company, or when the owners of the system offer too attractive conditions, such as low commissions and benefits, more profitable than those existing on the market.

How can you steal bitcoins during an exchange?

Sometimes wallets are hacked, private keys are obtained and replaced with their own.

Like wallets, services usually have access to private keys for ease of transactions. It is much easier to complete transactions when the exchanger stores your private key. If such a service gets hacked or the organizers decide to stop operations and steal money, there is little you can do to fix it.

You should look for a reliable exchange company by studying reviews and comments on forums and thematic sites.

How else can you steal bitcoins?

Non-existent goods from unscrupulous counterparties are another way to steal bitcoins.

There is no return of money in the cryptosystem; a completed transaction is irreversible. If the seller decides not to ship the item you purchased or refund your money, there is nothing you can do. You will simply become a victim of a scam organized to steal bitcoins.

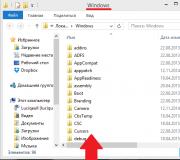

If the private key is stored on your computer and a hacker breaks in and finds the keys, they will gain access to your account and can steal your bitcoins. The attacker can be either a person or a spyware program.

Of course, you can steal keys stored on paper or a flash drive. Especially from a careless, gullible owner.

Thus, the most common way to steal bitcoins is to gain access to your private key.

So, you decided to take advantage of the drawdown in the cryptocurrency market and bought Bitcoin or some other coin, and maybe even traded on the exchange. How to save money? Now I’ll tell you about the types of crypto wallets and their features.

To begin with, wallets can be single-currency or multi-currency. The first ones work only with one currency, while the second ones support many different ones. Further, the entire variety of single-currency and multi-currency wallets can be divided into two types based on the storage principle: Hot. Keeping money in hot storage is the same as carrying bills and coins in your pocket. Cryptocurrency in such wallets will always be at hand and accessible from any device. This is good for quickly sending to the exchange, exchangers or other people, but bad from a security point of view, because the data, including the private key for sending funds, is stored on remote servers.

Cold. It's like you hide the money under the floorboard or lock it in a safe. Such wallets do not require constant connection to the network. Private keys and money are stored on your device or piece of paper. Yes, it is safe, but at the same time it is not very convenient if you need to send money urgently. Is everything clear? And now more details.

1. Controlled online wallets The easiest option to store cue ball, ether and other crypto is to use a hot wallet on some service. People like blockchain.info and Cryptonator.com. Hot wallets are issued to users of the LocalBitcoins.com site and traders on crypto exchanges.

Yes, it’s convenient and easy to store money somewhere there, but the remote server can be hacked, confiscated by the feds, clogged with DDOS attacks, blocked by the government, stolen by aliens, and the exchange, well, the exchange can also go bankrupt. Therefore, you should use such wallets only if you plan to actively trade. It is better to withdraw the same money that you decide to store into cold wallets.

🔥 If you decide to store money online, be sure to enable two-factor authentication and go through verification. Login and password alone are not enough for security!

2. Uncontrolled mobile and desktop wallets Here you will have to work hard and install the appropriate applications on your computer or smartphone. These wallets are safer than online wallets because your private keys will be stored on your device, but they are also suitable for quick cryptocurrency exchanges. Since these wallets require an active connection to the Internet, there remains a risk of hacking.

Jaxx, Exodus, Coinomi are some of the most popular uncontrolled wallets.

🔥 This type of wallet does not require registration via email or verification, so you will maintain your anonymity. However, this places full responsibility on you for access to your money, because if you lose the SEED phrase to your wallet and payment password, then no one will help you.

3. Hardware wallets Pocket safes, specially designed devices for storing cryptocurrency, similar in appearance to a flash drive. Ledger Nano S is the most popular and secure hardware wallet. In addition to Bitcoin and Ethereum, it supports Litecoin, Dash, Dogecoin, Bitcoin Cash, NEO, Ripple, Stellar, etc. The wallet connects to the USB port of your computer, is protected by a PIN code that you enter directly on the gadget, and a long recovery phrase of 24 words - it is generated by the device itself without the help of a computer. To operate with cryptocurrency, you will need to install a wallet client on your computer.

There is also Trezor and KeepKey, but after information about a vulnerability in ST32F05 chips appeared on the Internet, trust in these gadgets was undermined.

🔥 Included with Ladger Nano S you will find a card with 24 passwords. Take great care of it, because if your wallet breaks or gets lost, using one of these passwords you can order the exact same one from the manufacturer and recover your money.

4. Wat paper wallets?! Yes. Bu-maz-ny-e. But how?! Very simple. You create keys offline using the WalletGenerator.net program. You need to download the site code to your computer, disconnect from the Internet, then select the desired currency and generate public and private keys in the program, which you then need to print out on a piece of paper. The public key to receive money can be safely distributed to everyone left and right. Closed for shipping, of course, it needs to be hidden away.

🔥 By creating a paper wallet, it’s like going back in time - to the very times when money was paper. You could touch them, drop them out of your pocket, lose them in a fight with gopniks, or lose them after a night with a dubious lady.

5. State wallets In Russia, such wallets do not yet exist, but if you believe the recently published bill of the Ministry of Finance “On Digital Financial Assets”, they are about to appear. The thing is that the Ministry of Finance wants to prohibit Russians from buying and selling cryptocurrency without intermediaries, which will be “digital financial asset exchange operators” - offices that comply with the laws “On the Securities Market” and “On Organized Trading”. These legal intermediaries will issue “digital wallets” for Russians to store crypto, and only after full identification of the person in accordance with the law “On Combating the Legalization (Laundering) of Proceeds from Crime and the Financing of Terrorism.” What will happen to all those wallets that I talked about when the harsh plans of the Ministry of Finance come true? Will online wallets be blocked? Are smartphones and computers screened for illegal crypto-apps? Will the men in black confiscate hardware and paper wallets?.. Hmm, however, all this is too similar to some kind of futuristic plot worthy of an episode of Black Mirror.

Cryptocurrency, although a revolutionary monetary unit, like fiat money, requires care for its safety. Perhaps even more than fiat money.

Dmitry Laptev, co-founder of the XZEN project, talks about what troubles crypto account owners face and how to avoid it.

How crypto is stolen

At the exchange

On August 2, 2016, the Bitcoin rate fell by 20% in a few hours. On this day, one of the largest thefts in the history of cryptocurrency was committed.

Short video from the official Facebook Blockchain:

They all store the keys in encrypted form right on the phone. Some wallets allow you to use the NFC protocol. In this case, you do not enter any information to pay, you simply place your phone on the reader.

The peculiarity of all mobile wallets is that they are inferior crypto clients:

- The PC client downloads and stores the entire blockchain volume.

- Mobile applications download only a small set of information from the blockchain and rely on other trusted nodes in the Bitcoin network.

Conclusion: The disadvantage of a mobile wallet is that, like a PC, it can be hacked, stolen or infected.

3. Online wallets

There are many similar services, some of which can be linked to desktop or mobile wallets. Of course, they are convenient to use, since the account can be accessed from anywhere where there is Internet access. One example of this kind of wallet is the Strongcoin solution.

In this case, the data is stored in the cloud, on a third-party server. That is, a third party is included in the process, which may not be very honest.

There is also a risk of hacking of this third party - the site or exchange where the data is stored. And there is no way to protect yourself from this, as is the case with the Bitfinex exchange.

Hot storages are quite convenient to use and are in demand:

For example, those who trade on the exchange are forced to use hot wallets because they need quick access to the market through a smartphone. It is the ability to quickly access that is the common big disadvantage of hot wallets: all data is transmitted over the network, which can no longer be completely secure.

High level of security or so-called cold wallets:

Cold storage is so named because it does not have access to the network, which allows for almost complete elimination of third party intervention.

4. Paper wallet

One of the most reliable ways to store keys. Of course, you can write down the password on a notepad and store it in a safe. But there are sites that offer various methods of multi-stage data encryption.

Creating a paper wallet is quite easy. But it requires responsible storage: it is necessary to create reliable backup copies in case of loss or damage to the wallet.

Conclusion: Under no circumstances should you photograph, forward or leave the QR code in the public domain.

5. Hardware wallets

Small electronic devices, like a flash drive, that store private keys in such a way that they are almost impossible to retrieve. They do not have access to the Internet, but they can be used in devices connected to the network without the risk of infection or data loss.

Such a wallet does not “give” the private key to the computer, but uses it to sign the transaction, which is then transmitted to the application on the computer and further to the Internet.

The market for such devices is represented by several brands. For example, the Trezor hardware wallet costs €89 and supports different currencies: Bitcoin, Ethereum, ZCash and others. The device itself is protected by a PIN code and a secret phrase.

Photo from official account

Virtual currency is a new and universal means of payment on the World Wide Web. However, the number of people wishing to misappropriate hard-earned electronic currency is growing every day. Do you want to know if Bitcoin can be stolen? We have prepared a short educational program for you on this topic.

A little theory

First, let's talk about the currency itself. Bitcoin was born in 2009. The place of birth and existence is the Internet. Bitcoin is actively used for mutual settlements; it can serve as a means of payment between parties during the conclusion of a transaction, while an intermediary in the form of a bank is not required to make payments. Thanks to a decentralized management system, this type of electronic currency operates on the World Wide Web, without being under the control of any one company.

Paying with bitcoins is easy. Most often, sellers accept electronic currency without any commission. The problem is that both exchanges and users’ electronic wallets are a tasty morsel for computer attackers. The Internet is full of stories about hackers stealing Bitcoins. In addition, the price in the cryptocurrency market is constantly changing. As you can see, the number of risks is quite large, but this does not prevent many people from increasing their own capital with the help of Bitcoin.

You have Bitcoin, what is the risk of losing it?

According to financial experts, there are at least six risks associated with transactions using cryptocurrencies.

- Illegality

You can pay with electronic cash only with the seller's consent. Individuals and companies are not required to accept this type of money.

- Vulnerability

The computer systems on which bitcoins are exchanged are vulnerable and may be subject to attacks from outside. Stolen bitcoins are easy to sell, which is why cyber crime is on the rise. Recently, cases of hacking of electronic wallets have become more frequent, and hacker attacks on exchanges now and then excite electronic account owners who are familiar firsthand with how bitcoins are stolen.

- Cyber mimicry and scammers or how exactly bitcoins are stolen

Another risk with Bitcoin is related to mimicry, which is used by fraudulent sites. By faking the interface of exchange platforms and trading platforms, they conduct fake transactions, as a result of which bitcoins leave the client’s account into the unknown. It is impossible to cancel the transaction, and this is a rather sad fact. Another unpleasant moment is the large number of scammers who ingratiate themselves with the trust of exchange users. The result of the transaction is lost money.

- Lack of bank guarantees or is it possible to steal Bitcoin with impunity?

Since the role of an intermediary bank when paying with bitcoins is excluded, it is pointless to talk about guarantees after the transaction is concluded.

- Criminal activity

Since transactions settled in Bitcoin are almost 100 percent anonymous, they are often used for criminal purposes. The interest of law enforcement agencies in individual criminal elements can affect the operation of the exchange and force it to come under the close attention of people in the form of everyone who uses the services of such trading platforms.

In order to minimize risks when using bitcoins, you should be careful and use the services of trusted trading platforms and exchanges, and avoid communicating with anonymous resellers who know how to steal bitcoins. Also, under no circumstances should you indicate your private key on various services or wallets, even in order to receive a Bitcoin fork. And of course, no one should gain access to your hot wallets, much less cold ones. Store passwords only in trusted places!