How to use the Webmoney electronic wallet and what you need to know. Possible options for managing your account in Webmoney

Official date of creation payment system Webmoney can be considered 1998. Since then, this payment system has been constantly gaining momentum and at the moment remains the world's most popular electronic payment system. But despite this, questions about what “WebMoney” is not going away. Therefore, it is completely reasonable to raise this issue in order to understand it once and for all.

What is "WebMoney"?

If we compare the system electronic money With credit cards, then the first is, of course, a relatively new type of electronic money. Every year it is gaining more and more popularity, which is why it is difficult to find a person who does not know (at least superficially) that electronic money exists and many users of such systems continue to successfully work with them.

It should be noted that officially “WebMoney” are title units, each of which has its own specific cost based on its type category.

Why do you need WebMoney and where can you use it?

What is WMID for?

Each new registered user is given a 12-digit number, which is a personal identifier (WMID). Thanks to this number, you can quickly identify any user of the system, thus it acts as something like a login in the system.

Anyone can create “WebMoney” and get their WMID, and in the same way, every user can view all the information thanks to this identifier, so that the transaction is as secure as possible, and in case of fraudulent actions, you can file a claim with the service administration.

It is worth noting that for one VMID you can create not just one “WebMoney” wallet, but several, which makes it much easier to use.

What is WebMoney Keeper

If everything is clear with the question of what “WebMoney” is, then the next step will be to explain the concept of WebMoney Keeper. This is nothing more than special software that is provided free of charge to all users of the system. Thanks to this service, you can directly control your account and get easier and more convenient access to all services in the system.

Due to the fact that there are several varieties of specialized versions of this software, the user has the opportunity to choose exactly the type that will be primarily convenient for him and contain the entire range necessary functions that meet his requirements.

Main versions of WebMoney Keeper

WM Keeper Mini is the simplest version of the program, which is available in the browser. It is convenient primarily because thanks to it you can use your account from almost anywhere in the world where there is an Internet connection. Its security lies in entering mailbox, password and security code. There are restrictions on the withdrawal and transfer of funds, but this is only for your safety.

WM Keeper Light - this version of the program is as simple as the previous one, only it has additional protection and functions.

WM Keeper Mobile is a program for smartphones or phones.

W.M. Keeper Classic is an application that is assigned to personal computer. Maximum degree of protection and full spectrum services cannot but please, the only thing worth noting is the complex multi-step registration with confirmation of email and telephone number.

Despite this, step-by-step registration has hints to make it easier for you to navigate. You need to start from the official website, where you can download the software to your computer. Next, register, enter all the necessary data, including passport data, after which we create a wallet.

Creating a wallet

Before you start using it and appreciate all the advantages that electronic money has, you need to create a “WebMoney” wallet. This is necessary so that your savings have a certain place to be stored.

After the user has logged into the system, you need to find the icon that says “Wallets”, and then click on the plus sign “+” in the space provided for this.

Now all functions are available to you.

How to use

Now you can transfer funds to WebMoney in order to perform all kinds of operations with them. In order to deposit a certain amount of title units into your account, you need to choose one of the methods that will be relevant and convenient for you. Can be used:

- Exchange offices that exchange cash or non-cash money for title units of the service directly to your wallet; for this you only need to provide its unique number.

- Internet banking, ATMs and payment terminals. One of the fastest and most convenient ways.

- WM cards.

- Postal transfer.

In the WebMoney system, an invoice will be presented to the user, and after payment, the title units will arrive to your wallet.

Inside the system there is large number convenient services, thanks to which you can quickly and without unnecessary problems pay for various services, Internet or cellular communication. You can also find a store nearest to you that accepts title units of this payment system. And if you enter a current account in a special field, you can make connections. At the moment, almost the whole world accepts payment in this way.

If necessary, you can pay for any services, make a transfer, even take out or issue a loan. Most operations through WebMoney require confirmation of a login, password or other authorization method, depending on the keeper that is used.

Withdrawal and commission

Now it’s worth talking about the commission, which is charged to the user for almost any operation, with the exception of depositing funds. In all other cases - when transferring, withdrawing and paying for services - Webmoney charges a single commission, which is 0.8%. It is worth taking this into account when manipulating finances.

Now you know what WebMoney is and you can safely start working with this popular payment system.

Today, most Internet users have their wallets in electronic systems ah payments. After all, it is very convenient, you can pay fines, loans, utility bills, make purchases in online stores, top up your mobile account and pay for provider services - without leaving your home. And most importantly, withdrawing money earned on the Internet to bank cards through electronic wallets is very easy. In this article we'll talk about one of the most known systems calculation - Webmoney.

This is one of the first payment systems, of course, during its existence many analogues have appeared, but even today this service holds a leading position, largely due to its undeniable advantages:

- High level protection, How cash the user and his personal data. The wallet owner has the opportunity to configure identification options and trust for the account at their discretion. For example: enable “secure authorization” or confirmation of transactions via SMS;

- Convenient feature Webmoney registration certificates, which allows you to check the employer’s personal data. Very relevant for remote workers, it allows you to protect yourself from scammers. You only need to know the employer's WMID, which can be used to check reviews about the owner of this identifier and his level of trust;

- Cooperation of Webmoney with many banks in our country. Thanks to this, electronic currency can be withdrawn to almost any bank card, or receive in cash at the nearest branch of your financial institution;

- This system is accepted by most services for making money on the Internet., Webmoney currency you can pay in a huge number of online stores;

- Always available. You can make any necessary payment at home, at any convenient time, which is not always available in banking organizations. The system also allows holders of personal certificates to apply for and take out loans in Webmoney.

How to create a wallet in Webmoney?

To start using the most popular way payment on the Internet, you need to register in the system and open a wallet in the required currency.

To do this:

Types of Webmoney certificates and why they are needed

The WebMoney certificate confirms the presence of real existing person who owns the registered account in the system. This is a kind of personal identification document in digital format.

The system provides several types of WM certificates, they differ in the features of obtaining and the opportunities that their owners have. Today WebMoney Transfer provides two groups of “identification documents”: basic and professional types of certificates.

The main types are the most popular among users, what are their features?

Alias certificate

Issued automatically after a person registers in the system, that is, to receive it you only need to fill in the data specified in the registration form. Such a certificate makes it possible to make small monetary transactions in the system and replenish your wallets with cash. This type suitable for beginners who are just getting acquainted with the functionality and capabilities of this payment system.

Formal

You can also get this type of certificate for free by filling out your real passport details and confirming them by uploading a photocopy of your passport. It takes several days to issue the certificate.

Owners of this type can withdraw money earned on the Internet to their bank cards, link cards to their personal WMID, it becomes possible to pay not only mobile accounts and Internet provider services, but also taxes, fines, make other payments to accounts Russian companies and government agencies.

It also opens access to financial transactions through the CONTACT and Unistream systems. The owner of an account with this type of passport can leave reviews on official services and WebMoney blog, file for arbitration.

Elementary

Essential for small business owners and online companies. Only those registered participants of the WebMoney system who have previously issued formal certificate.

Issued both on paid and on free of charge. For checking passport data by a participant in the certification center’s affiliate program (in a personal meeting), a candidate for receiving initial certificate you need to pay up to 5 WMZ. In order to receive such a certificate automatically, you need to make a monetary transaction to fill your ruble wallet using one of the methods presented on the official website of the system (using Unistream, Contact, Anelik, from a bank account of any Russian financial organization, attaching a card from a partner bank), then submit an application to receive an initial certificate and details of the payment made to the Certification Center.

The initial type of certificate will be issued to the account owner in case of positive moderation no later than three working days.

Personal

This is the main type of certificate that provides high degree trust in its owner. Upon issuance, all data is checked personally by the Registrar upon presentation of the original documents.

Owners have access to many additional features: participation in affiliate program, access to the credit exchange is opened, setting up the receipt of payments from customers, creating budget machines, restrictions on appeals to arbitration are lifted, work in catalog sections in Megastock, it is possible to obtain the status of “system consultant”, etc. Personal certificate is issued and issued on a paid basis (cost about 15 WMZ) to holders of a formal or initial certificate.

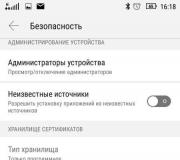

Possible options for managing your account in Webmoney

Mini

Connects automatically after registration account

. To log in and work, use any Internet browser, including mobile. This management method contains all the basic functions for working with wallets in the WebMoney Transfer system.

Light

Resource with advanced capabilities. It can also be controlled via an Internet browser, but with mandatory JavaScript support. To work, you need to download a system certificate. And if you need to log into your account from another computer, this certificate will need to be imported into another internet browser. To do this, you should copy the file with the p12 extension in advance for subsequent work.

Classic

If this method is used, the user needs to download special software from the official website of the system and install it on his computer. Many users believe that this is the most reliable and convenient way managing your money.

How to withdraw money from Webmoney?

Many users who choose as their main or additional income Internet, use the WebMoney system to withdraw earned funds.

Even though Recently the system had problems with withdrawing money from ruble wallets Due to the inspection of the Conservative Commercial Bank by Cetrobank and its recommendations for improving work with WebMoney tools, this payment system has not lost its popularity. The Webmoney administration carried out everything necessary work, eliminating the problems that have arisen. Now all system participants have the opportunity freely withdraw your money to a bank account or bank cards of any Russian banks via exchange offices the system itself or exchangers accredited in it.

It is worth noting that many exchange offices withdraw money to bank cards only of the owners of the account from which the payment transaction is made; withdrawals to cards of third parties are not made. Therefore, when a user plans to withdraw and cash out money through a third-party card, it is necessary to select a suitable exchange service that allows this operation.

As a conclusion, it can be noted that the Webmoney payment system is a reliable Internet service that is very popular among users. A competent administration promptly responds to emerging problems and does everything possible to stable operation this payment system.

Life modern people very closely connected to the Internet. Some people work on the Internet, others like to shop in online stores. Services have been created to make life easier and carry out various financial transactions electronic payments, on which you can create electronic wallets. One such system is WebMoney. It is not easy, because it has huge amount opportunities. This is why beginners often have the question of how to use WebMoney.

Getting to know the system

"WebMoney" is a long-existing electronic payment system. It was founded in 1998. The number of users choosing this system is growing every year. This is confirmed by the statistics generated by WebMoney. According to available data, in October 2017 the number of accounts exceeded 35 million.

"WebMoney" is international system settlements and environment for doing business on the Internet. It refers to several types of units of account, also called title units. Here are some of them:

- WMR equivalent Russian rubles;

- WMZ - dollar equivalent;

- WME - euro equivalent;

- WMU - equivalent to Ukrainian hryvnia;

- WMB is the equivalent of Belarusian rubles.

Registration in the system: how to start “WebMoney” and how to use it

Get e-wallet in WebMoney it’s quite simple. The registration procedure includes several steps. At the very first stage, a telephone number is indicated. It must be working, because in the future all financial transactions will need to be confirmed with codes received in SMS messages.

At the second stage, a form with personal data is filled out. You don't need much information to register. The new participant must indicate the date of birth, telephone number, Security Question to restore access and respond to it. Then all that remains is to confirm email address and phone number by entering codes. At the last stage of registration, you need to come up with a password to log into the system.

Creation of electronic wallets

After registration each new member the WebMoney system ends up in your personal account. At the top you can see the line “WMID” with numbers. People just starting to figure out how to use the WebMoney wallet in Russia should remember that this is a user ID in the system. It is not a wallet number. If we talk in simple language, then WMID is something like a number personal account, a platform on which you can create several different wallets for conducting financial transactions.

In your personal account there is special button to create wallets in different currencies. To create a ruble account you need to select WMR, to create a dollar account - WMZ, etc. Each wallet is automatically assigned a number. It begins with a letter that indicates the currency. For example, a ruble wallet begins with the letter R, and a dollar wallet begins with Z. It is important to remember that when replenishing a specific wallet or when making transfers to a specific wallet, you need to know its number. It is the wallet number, not the WMID.

What is important to know before using wallets?

After registration, every beginner can make small transfers and payments online. But there are users in the system who make large financial transactions. How to create a WebMoney wallet and how to use it so that more opportunities are available? To do this, you need to understand the certification system, which was invented in WebMoney. In accordance with it, each newcomer receives, after completing the registration procedure, a pseudonym certificate, which has certain restrictions. In order to make large transfers and payments, be able to withdraw funds in different ways A formal certificate is required. It is issued free of charge.

To obtain a certificate, you need to go to the appropriate section. At the top of the site, for those who do not know how to use WebMoney, there is a menu “For Individuals”. It has a “Certification” section. To obtain a certificate, you will need to go here and enter more detailed information about yourself: last name, first name, patronymic, passport details, SNILS number. In the “Certification” section you will additionally need to upload copies of your documents. It is not necessary to make photocopies. You can simply photograph your documents in good lighting so that all the data is clearly visible on them. Uploaded copies are checked by employees of the WebMoney certification center. At the end of this procedure, the user is awarded a formal certificate.

For those who are “lost” on the site

People who are using the electronic payment and settlement system for the first time find it quite difficult to navigate the site. After visiting any section, the question arises of how to return to your personal account and how to use the WebMoney wallet. To do this you should use top menu website, select “About the system”, “Wallet management”, “Keeper Standard (Mini)” and click the “Login” button. After this, your personal account will open, where you will see the created wallets and the amount of money in the accounts.

From your personal account you can:

- pay for various services;

- make transfers to other WebMoney electronic wallets;

- link your wallets to other electronic systems (Qiwi, Yandex.Money) and make further transfers between them;

- issue invoices to other WebMoney users when conducting any transactions;

- withdraw funds to bank cards.

Debt service "WebMoney": what is it?

All those people who saw the debt service probably thought about what it was. How to use this function in WebMoney? So, the debt service is a section of the site where you can receive loans from other owners electronic wallets. The function is not available to all users of the WebMoney system. It can only be used by those participants who have at least a formal certificate.

In the debt service you can see advertisements from lenders. The special table shows available amounts, term, percentage. If necessary, the borrower can only choose the most suitable conditions for him and submit an application. The lender, after considering it, may provide a trust limit, or may completely ignore the request. Sometimes lenders provide loans, but under completely different conditions that are unfavorable for the borrower. Users do this in order to protect themselves from non-returns.

Taking out a loan

Lenders typically lend very small amounts at first. Their size is comparable to the monthly Internet payment. In the future, after returns without delay, lenders gradually increase trust limits. Some even reduce the interest rate, making it more and more favorable for the user.

Taking out a loan deserves special attention, as this procedure raises many questions. If the lender has provided a trust limit, this does not mean that the money has already arrived in the wallet. In order to receive them, you need to apply for a loan yourself for the required amount and the required number of days.

Example of a loan application

The lender provided us with 10 WMZ for 30 days. We list our actions in step by step instructions"How to use the WebMoney wallet and the provided trust limit":

- Click on the limit and indicate the amount and period. Let's say we want to receive 5 WMZ for 10 days. We indicate these values in the fields that open. Below we will see the return amount - the number of title units that we will need to return to the lender. A participant in the system has issued a limit with a small interest rate, so we see a small amount to be returned - 12 WMZ. Next, we confirm your desire to receive funds.

- At the next stage, a contract appears. It states the amount taken, the amount to be returned and the deadline. Our consent is required. We press the appropriate button if everything suits us.

- It appears on our screen new page"Paymer". In it we see a significant amount - 24 WMZ. Some people close the browser at this stage, thinking that this is all a scam, because at first they agreed to a smaller amount. In fact, there is no fraud here. This will be confirmed by any person who has long known how to use WebMoney and is familiar with all the features. Paymer is a service in which unconditional bearer obligations are registered in double the amount of the debt. This agreement is used by the lender only if the user does not repay his debt.

- We confirm our consent by entering the code received on telephone number. The loan is immediately credited to your wallet. On the “Loans” page, located in the “Trust me” section, we see the amount to be repaid that we agreed to at the very initial stage, i.e. There are no double amounts.

The occurrence of debt in debt service

Users of debt services are not always able to repay their debt on time. Due to non-repayment, the specified amount goes into arrears. As a rule, in such cases, lenders turn off the provided trust limits and refuse further cooperation with unreliable participants in the WebMoney system.

Some lenders block the WMID of a user who does not return the funds in a timely manner. Due to the blocking, the ability to pay for services and withdraw funds from wallets is lost. How to use WebMoney in this case? To remove the lock, you will need to repay the loan. Additionally, lenders can file a claim on WMID. Because of this, it will be problematic to obtain trust limits from other users of the system in the future.

In case of delay by email a letter arrives - a pre-trial claim. It states that financial obligations were not fulfilled in a timely manner. The user is given a two-week period. During this period, you can repay the debt without any serious consequences. If the claim is ignored, the lender can sell the debt to third parties (collectors) or go to court.

"WebMoney" - a system with wide possibilities. Of course, it may seem difficult at first. How to use WebMoney is a question that will certainly arise. However, all the complexities and functions can be sorted out. The site itself has a help section. It contains articles that discuss various functions in detail. If you cannot find information on any questions or problems, you can always contact the support service.

Millions of people spend money online every day, buying goods and paying for services. Others make money by selling these goods and providing services. Nowadays, there are several monetary units that can be used to easily pay for almost everything that is sold on the Internet, perhaps the most famous of which is webmoney. Webmoney (webmoney)- electronic international monetary unit, which was founded in 1998 and allows you to conduct business on the Internet. To date, settlements with using webmoney lead tens of millions of companies, entrepreneurs and ordinary people.

What advantages does webmoney provide?

Now webmoney is so widespread in the world that with their help you can purchase almost everything, from a pin to an airplane:

- pay for Internet services;

- pay for television or telephone;

- buy cinema or train tickets;

- make a purchase in any online store that accepts webmoney;

- instantly transfer money over any distance.

In short, you can pay with webmoney for almost everything that is sold on the Internet.

How does webmoney work?

It is very easy to start working with webmoney.

For example, you want to purchase something, and the seller lives in another city or in another country and accepts webmoney. This payment can be made in 2 ways:

1. Create your personal webmoney wallet and pay from it. This method is suitable for those who will occasionally shop online. Briefly this method looks like this:

- You need to register on the webmoney website.

- Create one or more wallets.

- After creating wallets, you need to put money there. This can be done using a terminal, an ATM, through a bank cash desk, using Internet banking, bank transfer, payment card, telephone, etc.

- As soon as money appears in your webmoney wallet, you need to make a payment.

- After confirming the receipt of money in your wallet, the seller sends the goods (by mail, courier, etc.) or provides the service.

2. Pay for a product or service without creating a webmoney wallet. This method can be useful for those who want to purchase something and never use webmoney again. To make such a payment, you must obtain from the seller the number of his webmoney wallet and the exact amount that needs to be transferred. Then you need to make a direct payment in hryvnias, dollars, euros, rubles, etc. in the terminal, via Internet banking, bank cash desk, etc. Here, payment is made with real money, and the bank converts it into webmoney and puts it in the entrepreneur’s wallet. Then you need to provide the seller with a scan or photo of the payment receipt, after which he confirms receipt of the money and sends you the goods or provides the service.

Security of payments and transfers via webmoney.

The webmoney system takes a very serious approach to solving the issue of security of sending and receiving payments from its clients.

On the Internet, almost always, the seller and the client do not know each other, cannot meet, and the sale must be carried out remotely. This happens, for example, if you buy a product from a person living in another city, another country, or even on another continent. It is precisely in order to protect you from fraud (for example, you transferred money but did not receive the goods), so-called certificates were developed by the webmoney system. WM-passport is a special identity document that is certified by an analogue personal signature participant (entrepreneur). Function webmoney certificate is to confirm the reality of its owner, therefore it includes: full name, passport and contact information. Each webmoney certificate has its own level, depending on the amount provided by the participant personal information and on the method of checking it. Therefore, the higher the level of the certificate, the greater the degree of trust in it by the system itself and other users. Many entrepreneurs specifically place them in a prominent place in their online store. special image, which confirms that they have a webmoney certificate and its type, after viewing which their clients make purchases with peace of mind.

On the Internet, almost always, the seller and the client do not know each other, cannot meet, and the sale must be carried out remotely. This happens, for example, if you buy a product from a person living in another city, another country, or even on another continent. It is precisely in order to protect you from fraud (for example, you transferred money but did not receive the goods), so-called certificates were developed by the webmoney system. WM-passport is a special identity document that is certified by an analogue personal signature participant (entrepreneur). Function webmoney certificate is to confirm the reality of its owner, therefore it includes: full name, passport and contact information. Each webmoney certificate has its own level, depending on the amount provided by the participant personal information and on the method of checking it. Therefore, the higher the level of the certificate, the greater the degree of trust in it by the system itself and other users. Many entrepreneurs specifically place them in a prominent place in their online store. special image, which confirms that they have a webmoney certificate and its type, after viewing which their clients make purchases with peace of mind.

By concluding an agreement with the webmoney system, all participants (sellers and buyers) agree to the rules of use electronic currency, in case of violation of which they may be excluded from the system. For example, if an entrepreneur is deceiving his clients, then they can complain to the webmoney administration about him. After expulsion, this entrepreneur will never again be able to open a wallet with a certificate.

Types of webmoney wallets.

Each real monetary currency that webmoney works with has its own types of wallets associated with it, for example, WMU wallets are designed to work with hryvnias, to which only hryvnias are credited in the equivalent of 1:1. Other currencies are the same:

- WMU - hryvnia wallet (1 WMU = 1 UAH)

- WMR - ruble wallet (1 WMR = 1 rub.)

- WMZ - dollar wallet (1 WMZ = 1 dollar)

- WME - wallet for euros (1 WME = 1 euro)

- WMB - wallet for Belarusian rubles (1 WMB = 1 Belarusian ruble)

- WMK - wallet for Kazakhstani tenge (1 WMK = 1 tenge)

On the Internet, it is common to use virtual currencies for payments between users. Such equivalents of rubles, dollars, euros and other currencies are located in the virtual wallets of users registered in payment systems.

Using virtual currencies, you can not only make transfers to each other, but also pay for your mobile phone, pay for the Internet or other goods, even trips abroad. All these payments are made in just a couple of clicks. But first you need to get acquainted with at least one of these systems, for example, Webmoney.

Most experienced Internet businessmen have already learned what WebMoney is. After all, the service helps not only earn money, but also cash out the funds received using bank cards. This means that the money you earn online can be spent not only on the Internet, but also in completely real life, for example, at the market or in the nearest store.

Application of WebMoney limits in calculations

In order to understand how to use the WebMoney system, it is necessary to open the wallets necessary for the work. Further in your work, you can use several methods of sending and receiving payments:

- Classic,

- Mini,

- Light.

Each of them has restrictions on the amount of funds received and transferred.

The WM Classic program has the maximum resource. But there are still limits for users who have undergone full or partial identification by disclosing data, including passport data, to the service. These restrictions are regulated by certificates:

- pseudonym;

- formal;

- individual;

- personal.

Each of the certificates imposes overall limits on the balance in virtual wallet, daily or monthly volume of transfers.

Opening Webmoney wallets

Registration in the system is carried out on the pages of the official website webmoney.ru. To do this, you will need to provide your virtual mailbox email address and mobile phone number.

Opening a wallet in the WM Classic program

For security purposes, all external transactions are carried out with confirmation of the code from SMS messages.

When opening an account on the site, users are assigned a special digital code WMID, which performs the login function.

This is not a wallet number, but an identifier in the system. Also with it, all clients are provided with a key file in which data for conducting transactions with wallets is stored. It can be downloaded and uploaded to any convenient removable media. You will need it if operating system users will reinstall or send money from their wallets through other people's computers.

Since the downloaded program provides the largest limits on payments within its certificate Webmoney Classic, then it is used most often. When you first install it on your computer, it will ask for a password for WMID, as well as a password for keys and the location of keys from removable media. After entering this data, an empty program window will appear.

IN top line program, under the “Menu” button, a set of available commands pops up. Among them is opening a wallet. You can create wallets in several virtual currencies. It is advisable to have ruble and dollar accounts, since these are the most popular payment currencies on the Russian Internet.

The currencies in this system have slightly unusual names. For example, WebMoney virtual rubles are called WMR. And dollars represent WMZ. There are also euros, gold, bitcoins and several national currencies like Belarusian rubles (WMB) or Ukrainian hryvnia (WMU). They are more widely used in their own countries. The entire list can be seen when opening wallets.

The system allows you to open an unlimited number of wallets under one account (WMID).

The user may have his own reasons for this. For example, control of expenses or income in different areas. There is no cost for this.

Operations in the WebMoney system

enjoy Webmoney wallet, transferring money to it from your other wallets under one WMID is completely free. But if a system participant wants to send money to another user, then a standard commission of 0.8% will be charged for this operation.

Opening a WebMoney card

If the user received virtual payment in a currency that is inconvenient for him, he will be able to exchange it for a more comfortable one at any time. This is also done in the “Menu” of the WM Classic program. There is also a transfer button there. virtual money to one of the system users.

You can top up wallets in various ways both by bank transfer from a bank card and in cash at special terminals located in shopping centers, train stations, stations public transport and other crowded places.

You can link a bank card to your account and withdraw money earned online to it. The operation takes place instantly. You can then withdraw these funds from the card without any problems.

The WebMoney system also provides for the issuance of several types of cards, including virtual ones for safe shopping on the Internet. And you can release plastic card for withdrawing cash from ATMs. This is done through an account on the site pages.

Top-ups available for users mobile phones and payments for various popular services. A list of available destinations can be found on the WebMoney website.