Download the latest version of tax authority. Latest version taxpayer yul

« Taxpayer Legal Entity" is the official software developed by the Tax Service of the Russian Federation. Its main goal is to facilitate the process of preparing documents for submission to Federal Tax Service and automate this process. The software helps prepare both electronic versions of documents, exporting them to office program formats, and print reports.

To get started, you need to make sure that you have the latest version of the program installed. Since the requirements for reporting of individuals and legal entities to the Federal Tax Service are constantly changing, amendments or additional columns are made to the sample documents. If the version " Taxpayer" is outdated, the documents you prepared may not comply with current legislation.

The program facilitates the process of preparing documents by initially entering information about the organization into the database and saving it. When you start, you are asked to fill out information about the taxpayer, recipient INFS, select a reporting form and period. All completed information will be saved, making it easier to fill out declarations in the future. You can easily make changes if necessary.

Documents that are prepared using “Legal Taxpayer” 4.61:

- VAT information

- All types of personal income tax reports

- Insurance settlements

- Registration of CCP

- Application of unified agricultural tax, simplified tax system

- Taxpayer accounting

- Notification OFR, etc.

The software is fully translated into Russian and is compatible with OS Windows XP or higher. On our website you can download the latest version of the Legal Entity Taxpayer program 4.61 from 2019. Files are downloaded from the official website of the Federal Tax Service.

Screenshots

Taxpayer Legal Entity is the official software developed by the Federal Tax Service of the Russian Federation. The main purpose of this program is to automate the preparation of various types of documentation submitted by private entrepreneurs to local Federal Tax Service authorities. This solution greatly simplifies working with financial reporting, provides a lot of tools for filling out declarations, information and forms, and also allows you to export them to popular office formats.

Documentation

Using this software, individuals and legal entities have the opportunity to calculate insurance premiums, generate all types of personal income tax reports, fill out special declarations, draw up requests for financial services from counterparties, create invoices and registers of VAT information. Also, the Taxpayer Legal Entity helps when working with documents under the Unified Agricultural Tax, the simplified tax system, registration of cash registers and when working with powers of attorney. There are also components responsible for drawing up notifications from financial market organizations (financial market organizations) and statements for taxpayer registration. In short, it is a feature-rich solution covering the full range of tax and accounting reporting.

Functional

Among the interesting features of the program that help automate routine processes, it is worth noting the function of calculating indicators and establishing the correct order for filling them out. There is also a tool for generating paper media (sending documents for printing), electronic forms for maintaining a list of employees and contractors, as well as a section with the history of uploaded files. The latest version also introduces several step-by-step wizards needed for creating particularly "complex" documentation.

The graphical shell of the program is quite pragmatic. For easy navigation, the developer has provided a special panel and several drop-down menus. System requirements for Taxpayer Legal Entities are minimal. The software runs perfectly even on the weakest office PCs with outdated hardware and versions of Windows.

Key Features

- assistance in preparing a full range of tax documentation;

- several step-by-step wizards that automate work with the software;

- printing out the generated reports, as well as exporting them to popular office formats;

- pragmatic interface;

- very low system requirements.

Good afternoon dear friends! Today I want to tell you how to update the Taxpayer Legal Entity. This procedure is very important; the Federal Tax Service is constantly changing forms and report templates. Therefore, if you do not update the program in a timely manner, your report may simply not be accepted. Your report may be drawn up correctly, but because you have an old form, the tax office may simply reject the report. Let's get started!

How to update Taxpayer Legal Entity

If you are unable to solve this problem yourself, then you can go to the section and our specialists will help you.

Now let's find out which version we have. We launch the program and look at the program version in the header.

The version of the program is written after the words “Taxpayer Legal Entity”. In this case, I have version 4.57. And the latest version is 4.57.1. So we need to update the Taxpayer.

How to correctly install versions of Taxpayer Legal Entity

Now a very important moment!!! In order for the update to be correct, the sequence of versions must be followed. The first step is to install the full version. Then, an additional version. The full version always consists of three digits. In this case these numbers are 4.57, the next full version will be 4.58, then 4.59 and so on. Additional versions consist of four digits. For example, now we will install version 4.57.1, then there will be 4.57.2, then 4.57.3 and so on. It happens that there are no additional versions at all or, on the contrary, there are many. Recently it happened that there was version 4.56.6. That is, there may be many additional versions, or there may not be any at all.

Now let’s look at which version to install on which. First of all, we always install the full version, then additional ones. For example: you have version 4.56.3, and now the latest is 4.57.1. This means that first of all we install version 4.57. Then we launch our “Taxpayer Legal Entity”, the database is re-indexed and only after that we install 4.57.1.

If you start installing version 4.57.1, and you have version 4.56.3, then the “Legal Taxpayer” program will not update for you, or it will not update correctly!

Even if you have version 4.54.1 or 4.56, you can safely install a higher version, such as 4.57. That is, the higher FULL version can be installed on ANY previous one.

Now let's look at additional versions.

How to correctly install additional versions of Taxpayer Legal Entities

Let's look at everything again using examples. Now we will install version 4.57.1. In the future, version 4.57.2 will be released (or may not be released).

Let's assume that we currently have version 4.56.1. So we install version 4.57 first, and then 4.57.1. But remember! After installing each version, you need to run the program so that the database is re-indexed; only after re-indexing can you update the program further.

Now let's look at another option. You have version 4.57, and the update is 4.57.3. In this case, you do not need to install versions 4.57.1 and 4.57.2, but immediately install version 4.57.3. Is everything clear? If not, then questions in the comments.

Step-by-step instructions on how to update your Legal Entity Taxpayer

Theory is over! Now let's move on to the update process!

I have version 4.57, the latest version is 4.57.1. Download the latest update here. Let's unpack it. If you don’t know how to unpack a file, then read my article here.

Now we will definitely close the taxpayer legal entity program. Make sure a hundred times that you close the program. Otherwise you will lose all your data!

Let's launch the update. We see the “Welcome” window. Just click “Next”.

Now the most important step. We need to choose which folder to install the updates in. Right-click on the program shortcut and select “File Location”.

The folder with the Taxpayer will open. Let's look at the path. My Taxpayer is located at the path “C:\NP LE\INPUTDOC”.

You may have a different path! In the update program, we need to specify this path, only without the “INPUTDOC” folder. Here I have the path “C:\NP LE\INPUTDOC”, which means during the update process I specify the path “C:\NP LE”. After specifying the path, click “Next”.

After this, the update process will begin. After the update is completed, a window like this will appear. Just click “Finish”

Immediately after the update, a window like this may appear. There is no need to panic, just click “This program is installed correctly.”

Now we launch our Taxpayer Legal Entity and see the re-indexing that I told you about. Just wait, without pressing anything, and without turning off the computer and the program, otherwise everything will break!

Now look again at the program header to make sure that the update was completed correctly and the latest version is installed.

We see that I now have version 4.57.1. So the update went well and correctly!

If you need the help of a professional system administrator to resolve this or any other issue, go to the section and our employees will help you.

Now you know how to update the Taxpayer Legal Entity.

If you have any questions, ask them in the comments! Good luck and good luck to everyone!

To be the first to receive all the news from our website!

Managing an organization or running a business involves a lot of paperwork. To facilitate work with reporting and other papers, a special program “Legal Taxpayer” has been developed.

It is freely available to all users. New and previous versions are available to the client. Now there is no need to download document forms for various authorities and filling out samples, or search for information about new reporting forms. Everything is available in the “Legal Taxpayer” application.

Any program has requirements for the parameters of the device where the installation will be performed. If at least one item does not match, installation will be impossible or the application will not work correctly. In fact, Taxpayer Legal Entity is a standard office application that works without problems on modern laptops and computers. The table below provides the basic device requirements for installing the new version of the program.

| operating system | Windows vista, XP, 7, 8, 8.1, 10 |

| RAM | At least 512 MB |

| Hard drive | At least 600 MB |

| Video card | 1020*768 |

Service capabilities

The Legal Entity Taxpayer program is aimed at heads of organizations and representatives of small businesses. The main purpose of the service is to facilitate work with various documentation. To automate the process, you need to download the latest version and install it. After familiarizing yourself with the interface and functionality, you can start working.

Advantages of the service:

- The program is Russified, which eliminates problems in its development.

- Built-in accountant calendar that guarantees timely submission of reports.

- The service provides reference books to help inexperienced users prepare documents.

- You can make a backup copy of your documents and not worry about losing them in the event of system problems.

- One user can use “Legal Taxpayer” to work with the documentation of several companies or individual entrepreneurs.

- Possibility to use a portable or desktop version of the program.

- Taxpayer functionality

The application is in demand not only among entrepreneurs and company owners. It is successfully used by private individuals who, due to their duties, are forced to work with a large amount of paperwork. In fact, installing a “Legal Taxpayer” is equivalent to hiring a personal assistant.

Main features of the service:

- Creation of documents for submission to the Federal Tax Service and other government agencies.

- All documents are created automatically.

- In the application you can find a template for absolutely any document.

- Possibility of printing the necessary documents.

- Accountant calculator - this function helps you track how many hours each employee has worked. This is necessary for maintaining work sheets and correct payroll.

- The service has a forum where you can get advice on any questions you may have.

Installing the application

Before installing the product on your computer, you need to download the file with the new version of the program. The Federal Tax Service provides it to us free of charge on the official website. You can find the download link at the very bottom of the page, in the “Software” section. Next, a list of services will open, from them you need to select “Taxpayer Legal Entity” and click on it.

On the page that opens, you will be asked to download the complete installation kit in one file. Typically, users are offered the new version by default. To start downloading, click “Download”.

By default, new files are automatically saved in the Downloads folder. You can choose the location where the “Legal Taxpayer” will be saved. After downloading, you can begin installation.

Advice!

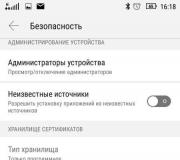

Before you begin installing Taxpayer Legal Entity on your computer, it is recommended to disable your antivirus.

The installation process may take a lot of time, you will have to be patient.

Pay attention!

Taxpayer legal entity is adapted only for Windows OS.

Installation order:

- Find the folder with the downloaded file on your device, double-click on it. Give permission to run the file.

- Then you need to extract it from the archive, this may take several minutes.

- All extracted files are saved to the INSTALL folder located below.

- After unloading the components, the installation window will open. You must confirm that you accept the terms of the agreement and click the “Next” button.

- You will then be offered different installation options. The choice is your own, but it is recommended that you opt for a full installation. After making your selection, click “Next” again.

- In the new window you need to select a location for the “Legal Taxpayer” on your device. By default, the folder has already been created and a location has been defined for it. It is recommended to continue the process without changing anything.

- All that remains is to run the installation. The process will take a few minutes.

- When everything is finished, click “Done” in the window that opens.

A shortcut will appear on the desktop. Double-click on it, “Taxpayer Legal Entity” will launch and re-indexing will begin.

In simple words, this is an internal setting. There is no need to confirm anything here; everything is done automatically. The procedure is carried out once, after downloading and installation. There will be no re-indexing during further work. When it's finished, you'll be prompted to add the taxpayer and the required information.

It happens that it is not possible to download the installation file on the Federal Tax Service portal. You can quickly download it from here. This is the official website of the developer, where you will find the latest version of the Legal Entity Taxpayer. The installation procedure follows the instructions described above.

Possible installation problems

Often, when installing the “Legal Taxpayer”, one or another problem arises. The most common one is the requirement to restart the computer, after which the application does not want to open. You need to restart the installation. To avoid problems, it is recommended to exit the browser and close other active applications.

The second common problem is the appearance on the screen of information that the program contains dangerous viruses. If you downloaded “Legal Taxpayer” on the Federal Tax Service portal or the developer’s website, there are no malicious files in it. An antivirus tends to perceive individual components of an application as a potential threat, hence the conflict during installation. Most likely, you forgot to disable security software.

During installation, a message may appear indicating that some installation files are damaged. The solution is to delete the download file and download it again (perhaps the download failed). Before doing this, check your network connection. If you were provided with an installation file on a disk or flash drive at a tax office branch, the source of the problem may be damaged media. Rewrite the application to a new disk, or contact the Federal Tax Service with a similar request.

For regular and fruitful work, a one-time installation is not enough. “Legal Taxpayer” needs regular updating. The fact is that new documentation forms appear several times a year. If you did not take care to purchase a new version, your reporting will not be accepted at best. You can find the updated version on the developer's website.

Before you begin your search, you need to know the version of Legal Entity Taxpayer that you are currently using. Information is in the program header. The latest version is 4.58.

In order for the taxpayer to work correctly after the update, it is necessary to perform the procedure in a certain order. There is one caveat - full versions of the program are released (numbered with three digits), and additional ones (numbered with four digits). When updating, you need to install the full version first, for example, 4.57. Then 4.57.1, 4.57.2 are superimposed on it, and so on in increasing order. Sometimes additional versions are not provided.

For example, let's consider updating the “Legal Taxpayer” to version 4.58. We go to the Federal Tax Service portal or follow the link, select the new version (in our case 4.58). In principle, everything then follows the same pattern as the initial setting of “Legal Taxpayer”.

Important!

Before installing the new version, you must exit the “Legal Taxpayer” that you used previously. Otherwise, loss of data and documentation is guaranteed.

During the update process, you need to select a folder for the new version of the program. When everything is finished, you will see a window asking you to end the process. Click the "Finish" button and that's it - the new version is installed.

On your desktop, find the “Taxpayer Legal Entity” shortcut and open it. Re-indexing will begin - you don’t need to do anything, the system will be configured automatically. When the process is finished, pay attention to the program header. The new version should be listed there.

Unfortunately, some users, when launching a new version, discover that the entire database with stored information and documents has disappeared. If you suffer the same fate, you can try to figure out the problem and restore everything.

The first way to solve the problem is to try to find the folder where the new version ended up. There is a “Service” section in the application header, click on it. In the “Miscellaneous” item, select “Search for program folders.”

The process will take from a few seconds to several minutes. The system will scan your disks and reveal all the folders in which the new version of the taxpayer could be hidden. The appearance of the list is a good sign, the base is saved.

First you need to remove the taxpayer from the “unnecessary” folder (it is recommended to do this through the “Start” menu, then find “Uninstall a program”), but first it is recommended to remember the path to the place where the previous version is installed. All that remains is to perform the installation again in the desired folder (by default, the new version ends up on drive C). Upon completion of the installation, re-indexing will begin again - all databases are synchronized. If the reinstallation is successful, you will see a list of all taxpayers.

Also, in case of problems and freezing when starting “Legal Taxpayer”, you can use the Windows event log (an event means any action on the part of the user). Login is performed according to the following scheme: Start - Control Panel - Administration - Event Viewer - Application (next select the desired program). All errors are highlighted with a specific red circle. To view you need to click on each of them.

Answer: Run the installer again.

2. Question: During installation, the program asks for drive F (can be E, B, H ... ZAnswer: Apparently the previous version was installed from this disk. Create drive F, it doesn’t matter what will be on it (for example, connect any resource as drive F - my computer / connect a network drive) and run the installation program again.

3. Question: Is the data I entered in the “Legal Taxpayer” program deleted when installing a new version over the old one or when uninstalling the program?Answer: No. If you do not delete the folder where the program was installed, the installation program does not delete any entered data.

4. Question: After installation, I do not see the previously entered data (reporting forms)Answer: Everything is fine. Options:

1. You installed the program in the wrong folder:

On the computer where the program was installed, select the menu item in the NP LE program Service/Miscellaneous/Search for folders with the program;

After the mode has been running for as long as possible, a list of folders will appear where the program was ever installed and you worked with it;

In the list of found folders, you will see information about where the program was installed, when you last entered it, how many NPs were entered in it;

Remember the path to the option you need;

Uninstall the program - Start/Programs/Taxpayer Legal Entity/Uninstall a program;

Install the program according to the path you remember.

2. The entered data (reporting form) is in a different period from the current reporting period - this can be resolved by changing the reporting period in the upper right corner of the program window;

3. Descriptions of reporting forms are not accepted; Check the availability of the required forms in the "Settings - Reporting Forms" mode; if not, download (the "Download" button).

5. Question: It is not possible to install Taxpayer Legal Entity with the installation program. What to do?Answer: You can install the “Legal Taxpayer” program “manually”. To do this:

1. copy the folder INSTALL445\Taxpayer Legal Entity\ into c:\npul\ from the distribution kit

2. create a shortcut on the desktop to c:\npul\Inputdoc\inputdoc.exe

3. run the installation program "c:\npul\Print ND with PDF417(3.1.15).msi"

4. run the file c:\npul\reg.bat with administrator rights

Answer: the distribution files were damaged either when copied from an electronic medium or received via the Internet or as a result of a virus

If you downloaded the version via the Internet, check that your computer has a stable connection to the Internet and download the program installation package again

If the version was written to disk by the Federal Tax Service, try copying it from another computer or write it down again

7. Question: What should I do if, when installing the Legal Entity Taxpayer software, my computer reports the presence of viruses in the program?Answer: The Legal Entity Taxpayer software does not contain viruses, however, some installation files may be incorrectly classified by the anti-virus program as a suspicious object. Since the user's anti-virus program may perceive some installation files as a virus and not allow them to pass through, it is recommended that during installation and the first login to the program after installation, we recommend disabling anti-virus programs. In addition, the check slows down the program many times over and can even block its operation or the creation of a necessary file.

Solving problems that may arise during startup

1. Question: After installation, when entering documents, a window appears asking for *.ocx files, click on the “Cancel” button and an error appears:"OLE error code 0x80040154: Class not registered. OLE object ignored. Entry number 6"

"Internal error 2738"

Answer: Run the reg.bat file (may require launch from an administrator) from the program folder (usually c:\Taxpayer Legal Entity\Inputdoc\reg.bat)

2. Question: when trying to start the program, messages like:

"Resource file version mismatch"

"The library MSVCR70.DLL was not found at the specified path..."

"Visual FoxPro library is missing"

Visual FoxPro cannot start

Could not load resources

Incorrect path or file name

Resource file version mismatch

Cannot locate the Microsoft Visual Foxpro support library

or the Microsoft Visual Foxpro window appears and the prg(fxp) file selection dialog appears

the program itself does not start

Answer:

1. if you launch using a shortcut on the desktop, make sure that the location where the Legal Entity Taxpayer program is installed matches the working folder in the properties of the program shortcut (for example:

- the program is installed in "C:\Taxpayer Legal Entity\"

- Object (Target): "C:\Taxpayer Legal Entity\INPUTDOC\inputdoc.exe"

- Working folder (Start in): "C:\Taxpayer Legal Entity\INPUTDOC\"

2. make sure that there are files in the working folder:

gdiplus.dll (1 607K)

msvcr71.dll (340K)

vfp9r.dll (4 600K)

vfp9rrus.dll (1 416K)

if they are not there, or the size does not match, disable antiviruses and run the version installation program again, select the “fix” option

3. try disabling the antivirus and running the program without it

4. perhaps in the windows\system32 folder there are files vfp9r.dll, vfp9rrus.dll, vfp9renu.dll, config.fpw - delete them from there and try to run the program

5. It is possible that in the PATH environment variable (my computer/properties/advanced/environment variables button), the %SystemRoot%\system32 directory is present more than once - d.b. once

3. Question: There are hieroglyphs in the program instead of letters, how can I fix it?Answer: 1. Set Russian on all tabs of the regional standards settings window (Control Panel/Language and Regional Standards) - pay attention to the language of programs that do not support Unicode on the Advanced tab - add “Russian”;

2. if this does not help, load the classic scheme in the Windows display settings;

3. if that doesn’t help, change the system language to English, reboot, then again into Russian and again reboot;

4.Attention! When changing languages, Windows may display a message stating that some files are already on the disk and suggests using them. Don't agree and select the file from the windows distribution. The point of these actions is to restore language files from the windows distribution.

1. Control Panel, Regional Standards, On the Formats tab, select the English format, on the Advanced tab (Language of programs that do not support Unicode), click the "Change system language" button, select English

2. Reboot!

3. Control panel, Regional standards, On the Formats tab, select the Russian format, on the Advanced tab (Language of programs that do not support Unicode), click the "Change system language" button, select Russian

4. Reboot!

5.Attention! sometimes the method helps on the second or third try

On some windows distributions, changing the language may not help - there may be a problem with the ms sansserif font - download it and install it.

Windows 98, 2000, XP if that doesn't help:

Run the registry: "Start" - Run - "regedit"

Follow the path

HKEY_LOCAL_MACHINE\SYSTEM\CurrentControlSet\Control\Nls\CodePage

change the value of the string parameter "1252" from "c_1252.nls" to "c_1251.nls"

4. Question: Error message C0000005 appears... What should I do?

Answer: In the folder with the program, after such an error, there will be a file VFP9Rerr.log. Send it to [email protected]

5. Question: Sometimes an error occurs when accessing files located in the Windows temporary folder ( \Documents and Settings\...\Local Settings\Temp or \Users\...\Local Settings\Temp)

Answer:

-in this case, as a rule, it helps to either move the program’s temporary folder from “Documents and Settings” (for example, to c:\IDTMP\) - for this you need to set the environment variable IDWTEMP=c:\IDTMP\

This may be caused by the antivirus - try disabling it and working, if the error does not recur in the antivirus settings, exclude files like *.dbf, *.fpt, *.cdx, or the c:\IDTMP\ folder from the scan